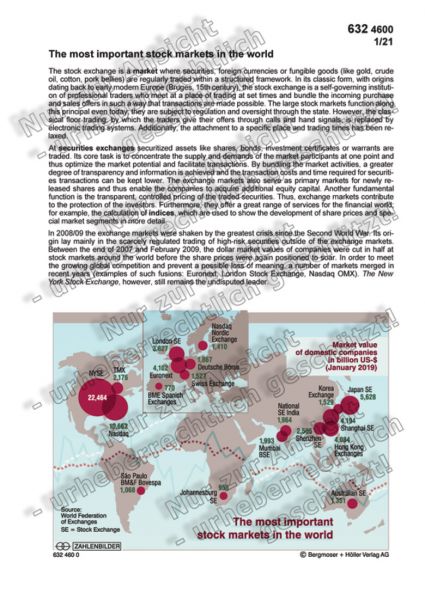

The most important stock markets in the world

Infografik Nr. 632460

| Verlinkung_zur_deutschen_Ausgabe |

The stock exchange is a market where securities, foreign currencies or fungible goods (like gold, crude oil, cotton, pork bellies) are regularly traded within a structured framework. In its classic form, with origins dating back to early modern Europe (Bruges, 15th century), the stock exchange is a self-governing institution of professional traders who meet at a place of trading at set times and bundle the incoming purchase and sales offers in such a way that transactions are made possible. The large stock markets function along this principal even today; they are subject to regulation and oversight through the state. However, the classical floor trading, by which the traders give their offers through calls and hand signals, is replaced by electronic trading systems. Additionally, the attachment to a specific place and trading times has been relaxed.

At securities exchanges securitized assets like shares, bonds, investment certificates or warrants are traded. Its core task is to concentrate the supply and demands of the market participants at one point and thus optimize the market potential and facilitate transactions. By bundling the market activities, a greater degree of transparency and information is achieved and the transaction costs and time required for securities transactions can be kept lower. The exchange markets also serve as primary markets for newly released shares and thus enable the companies to acquire additional equity capital. Another fundamental function is the transparent, controlled pricing of the traded securities. Thus, exchange markets contribute to the protection of the investors. Furthermore, they offer a great range of services for the financial world; for example, the calculation of indices, which are used to show the development of share prices and special market segments in more detail.

In 2008/09 the exchange markets were shaken by the greatest crisis since the Second World War. Its origin lay mainly in the scarcely regulated trading of high-risk securities outside of the exchange markets. Between the end of 2007 and February 2009, the dollar market values of companies were cut in half at stock markets around the world before the share prices were again positioned to soar. In order to meet the growing global competition and prevent a possible loss of meaning, a number of markets merged in recent years (examples of such fusions: Euronext, London Stock Exchange, Nasdaq OMX). The New York Stock Exchange, however, still remains the undisputed leader.

| Ausgabe: | 03/2021 |

| Reihe: | 53 |

| color: | Komplette Online-Ausgabe als PDF-Datei. |

| Reihentitel: | Zahlenbilder |

| s/w-Version: | Komplette Online-Ausgabe als PDF-Datei. |